In the U.S., a number of startups aim to be the corporate spend manager of choice for small and large businesses. Brex, Ramp, and Mercury are among those companies, just to name a few.

Moving north of the border to Canada, the options are fewer, but growing.

Keep is a startup that has built a financial platform specifically designed for small and medium-sized businesses (SMBs). On Tuesday, it announced a total of $23 million in equity funding, a $50 million credit facility, and a $3 million venture debt line, it shared with TechCrunch exclusively.

This year, Keep raised $12 million in what it describes as a Series A1 round that was led by Tribe Capital. It previously raised $8 million in a Series A led by Tribe Capital in May of 2023, and $8 million in a seed round in November of 2021.

Treville Capital Group provided the credit line, and Silicon Valley Bank the venture debt. Keep co-founder and CEO Oliver Takach declined to reveal the startup’s valuation, saying only that Keep “had a 5x step up in valuation from the Series A and 20x increase in revenue.”

Takach is no stranger to startups. Prior to co-founding Toronto-based Keep with Helson Taveras in 2021, he was a two-time Y Combinator founder (CareLedger, YCS15, and Origin, YCW17; both startups are now inactive). He also helped found another startup called Retriever that was sold to a marketing company. Over the years, Takach and Taveras struggled with available financial tools, especially those provided by traditional banks, so they decided to build an offering of their own.

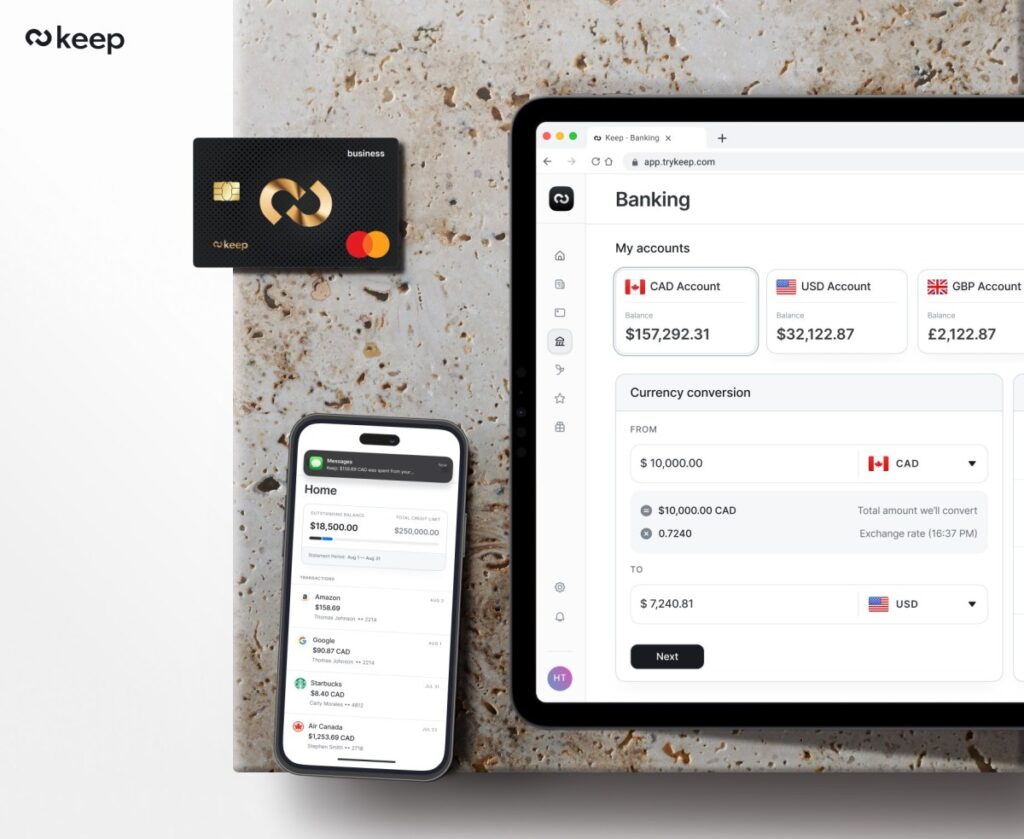

In 2023, Keep launched its corporate credit card as part of its quest to serve as “the mission control center for a company’s finances.” Besides the corporate card, Keep offers businesses multi-currency accounts, automated expense management, and integrations with accounting software.

In 2024, Keep crossed $14 million in annualized revenue and onboarded over 3,000 SMB customers that operate across a mix of industries, many of which do business internationally. The company makes money in part by earning interchange revenue when businesses use its corporate cards. It also charges fees for capital advances and short-duration installment loans, and earns revenue from premium payment options when customers send funds instantly or exchange currencies.

Toronto-based Float Financial also aims to serve SMBs in Canada and is Keep’s closest competitor, according to Takach.

In his view, one of Keep’s differentiators is its multi-currency capabilities, which help its customers “bank like a local” and allow cross-border operations.

Tribe Capital led Keep’s latest equity raise, which included participation from existing and new backers Rebel Fund, Liquid 2 Ventures, Cambrian, and Assurant Ventures. Several angel investors, including Dropbox co-founder Arash Ferdowsi, Webflow co-founder and CEO Vlad Magdalin, Alloy co-founders Tommy Nicholas and Laura Spiekerman, and Marc Bhargava, a managing director at General Catalyst, also participated in the financing.

“Managing expenses, sending and receiving money, handling currency exchanges seamlessly, and giving employees controlled access to funds are now table stakes,” Arjun Sethi, co-founder of Tribe Capital, told TechCrunch. “Vertically integrating these services isn’t a luxury anymore — it’s the new standard.”

Looking ahead, Keep aims to launch a banking product and add more features, such as embedded credit options and bill pay.