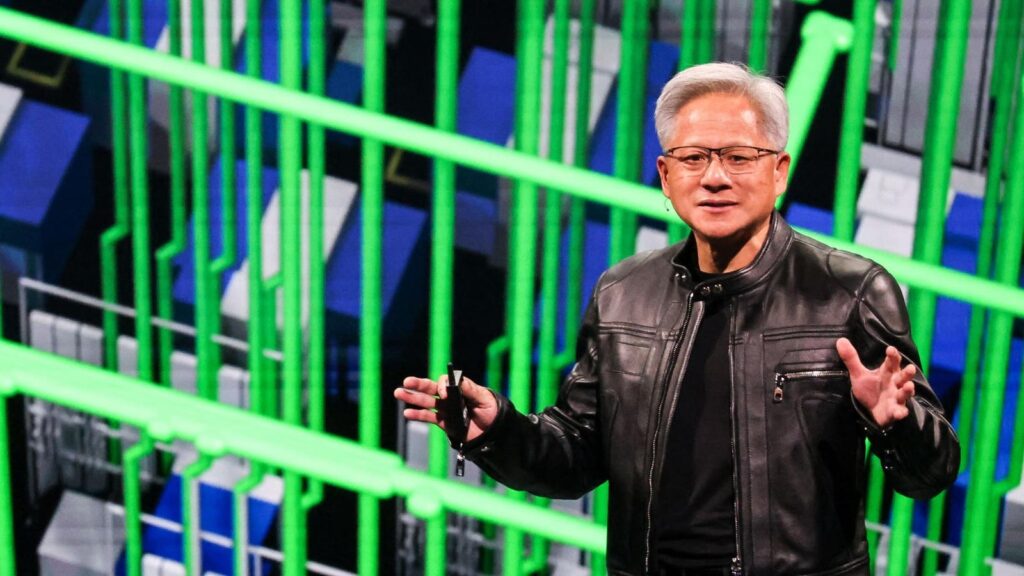

Nvidia’s cofounder and CEO Jensen Huang is worth an estimated $125 billion thanks to its stock’s rapid rise.

I Hwa Cheng/AFP/Getty Images

The whiplash growth of artificial intelligence has minted a gaggle of billionaires and unicorns, but chip behemoth Nvidia continues to remain among the largest beneficiaries of the AI boom against all odds.

The company took a hit on the $50 billion Chinese AI chip market after the Trump administration placed export controls on its H20 chips, which “effectively closed” the market to the U.S. industry, CEO Jensen Huang said in a recent earnings call. Earlier this year its stock briefly nosedived after Chinese darkhorse DeepSeek’s popular AI model launch triggered a panic sell-off.

Despite challenges—external and internal—the $3.5 trillion (market cap) juggernaut has continued to capitalize on the global demand for AI infrastructure. In its latest quarterly earnings in May, Nvidia beat Wall Street analysts’ expectations and reported $44.06 billion in revenue, up 69% from a year ago.

A hefty portion of its business growth, $39.1 billion of its revenue, comes from its data center operations as the company plans to build “AI factories” in the US and internationally that will help billions of people across the world run AI tools like ChatGPT. In late May, Nvidia said it will supply its powerful silicon chips to Stargate UAE, a joint project with OpenAI, Oracle and others to build a 1 gigawatt “compute cluster” in Abu Dhabi’s AI campus.

Such projects have helped push the company to the top 100 on Forbes’ Global 2000 ranking the world’s largest public companies. It’s now at position No. 47, 63 spots higher than last year, thanks to a period of strong business growth spurred by widespread use of generative AI. The company is now among the likes of massive tech conglomerates like Tencent (No. 37) and Taiwan Semiconductor (No. 38). The Global 2000 measures market value, revenue, profit and assets equally using the last 12 months of data as of April 25, 2025.

Even as AI companies have shifted from training large language models to building applications on top of them, they require a steady supply of Nvidia’s powerful silicon chips called graphics processing units (GPUs) to do what’s called inference— where a model produces an answer based on new information fed to it in real time. To top that, new so-called “reasoning AI models” that take a step-by-step approach to answer complex problems consume 100 times more computational resources, creating more demand for Nvidia’s hardware.

While Nvidia is the market leader, other companies are growing as well. Semiconductor company Micron, which builds memory and data storage products, has hopped more than 400 spots on the list and is now at No. 228. And South Korean memory chip provider SK Hynix Inc is up 419 spots to No. 155.

But not all semiconductor companies have benefited from the AI frenzy. Silicon Valley stalwart Intel, now at No. 488, dropped 381 spots on the Forbes’ Global 2000 this year. The company has struggled after a string of woes including declining revenue, leadership challenges and losing its market share to rivals like Advanced Micro Devices (AMD) and Arm Holdings. In December 2024, Intel’s CEO Pat Gelsinger stepped down, and was replaced by Lip-Bu Tan in March 2025. In April, the company said its plans to lay off 20% of its staff, Bloomberg reported.

The largest tech companies like Microsoft, Meta, Amazon and Alphabet have all made gigantic bets on artificial intelligence, throwing billions of dollars and the best engineers to develop AI models and build products for their users. Those four firms are all among the top 20 of the Global 2000. South Korean conglomerate Samsung is the only tech giant based overseas in the top 20, moving up to 19th this year.

One new AI beneficiary to watch is CoreWeave, which rents cloud computing power to customers and went public in March. It’s making its first appearance on the list at 1,799th this year and is likely to move up fast. It’s not profitable yet, but after the data was compiled for this year’s Global 2000 on April 25, it reported $982 million in first quarter revenue, a 420% increase compared with the first quarter last year, and its stock price has surged 250%.

MORE FROM FORBES